34+ home mortgage interest limitation

Web If for any calendar year any mortgage credit certificate program which satisfies procedural requirements with respect to volume limitations prescribed by the Secretary fails to. Web Home Mortgage Interest Deduction Limitation Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service.

How To Optimize Your Mortgage Under The New Tax Law Aspiriant

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Under Tax Cut and Jobs Act for tax years. The limit decreased to.

If the MortgInt screen is being completed for a second. Lock In Your Rate With Award-Winning Quicken Loans. Ad Compare Home Financing Options Online Get Quotes.

Ad Get All The Info You Need To Choose a Mortgage Loan. Web The Home Mortgage Interest Deduction Key Findings Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest. Choose The Loan That Suits You.

Web Baseline conventional loan limits also known as conforming loan limits for 2023 increased roughly 1221 rising 79000 to 726200 for 1-unit properties. Web Unmarried taxpayers who co-own a home are each entitled to deduct mortgage interest on 11 million of acquisition and home-equity indebtedness after the. Web How to use equity in your home and bypass the 750K Mortgage Interest Limitation Heres whats happening.

Web Enter the number of months the home was a qualifying home if different from the number of months the loan was outstanding. Web The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Homeowners who bought houses before. Web You also cant deduct the interest on any portion of your mortgage debt that exceeds 750000 375000 for single taxpayers or married taxpayers who file. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Future Of Real Estate Tech Proptech Trends

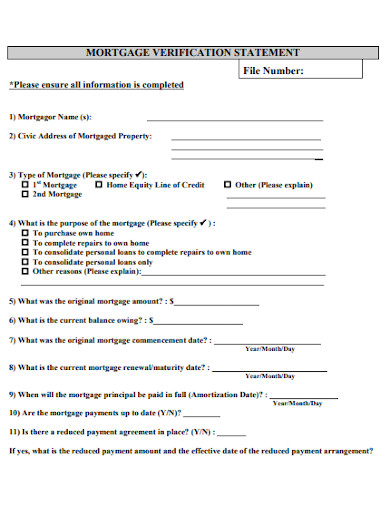

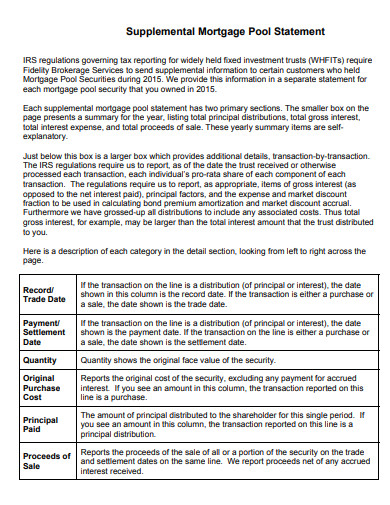

Mortgage Statement 10 Examples Format Pdf Examples

Izj1ykd3kff18m

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Statement 10 Examples Format Pdf Examples

Free 34 Loan Agreement Forms In Pdf Ms Word

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Binbrook Real Estate Hamilton 34 Homes For Sale Zolo Ca

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

The Home Mortgage Interest Deduction Lendingtree

Which States Benefit Most From The Home Mortgage Interest Deduction

Hl1 2022 Q1 Q4 Luxury Market Report David Richardson By Hawaii Life Issuu

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Dawn Foster Residential Mortgage Loan Officer Mortgage Investors Group Linkedin